These are the parameters that I use when I am looking for TTM squeeze setups. There are often times that I will go outside of these parameters. However, these are the ideal setups.

- Within 10% of 52 week high

- Over $25

- Avg daily Vol over 200k

- High short interest – this can be played with on the amount % you use. Prefer over 15%

- Must be in a TTM squeeze, always play the time frame you bought with – if you bought using the 78M chart, use the rules according to that time frame.

- It is better to use the longer time framed squeezes over the short. If a 78, 130, and daily squeeze are occurring, use the daily time frame. However, if you are wanting to get in on a chart and it is not coming back to the 8EMA on your squeeze, look for a lower timeframe squeeze to play.

Entry and Exits

- Must buy at or below the 8 EMA, preferably between the 8 and 34 EMA. Depending on the strength of the stock the Trend will determine where I enter. 21EMA entries are common for me. I size in, meaning I do not buy a full position at one time. I’ll buy ¼ at 8EMA ¼ at 21 EMA ¼ at 34 EMA etc. Can play off lower Bollinger Band as well

- Stop out with close below lower BB or predefined SL.

Extras

- The more squeezes on the time frames the better, example if the 15,30,60,78,120,130,195 are Squeezing I call these stacked squeezes. This means a hell of a lot of energy built up.

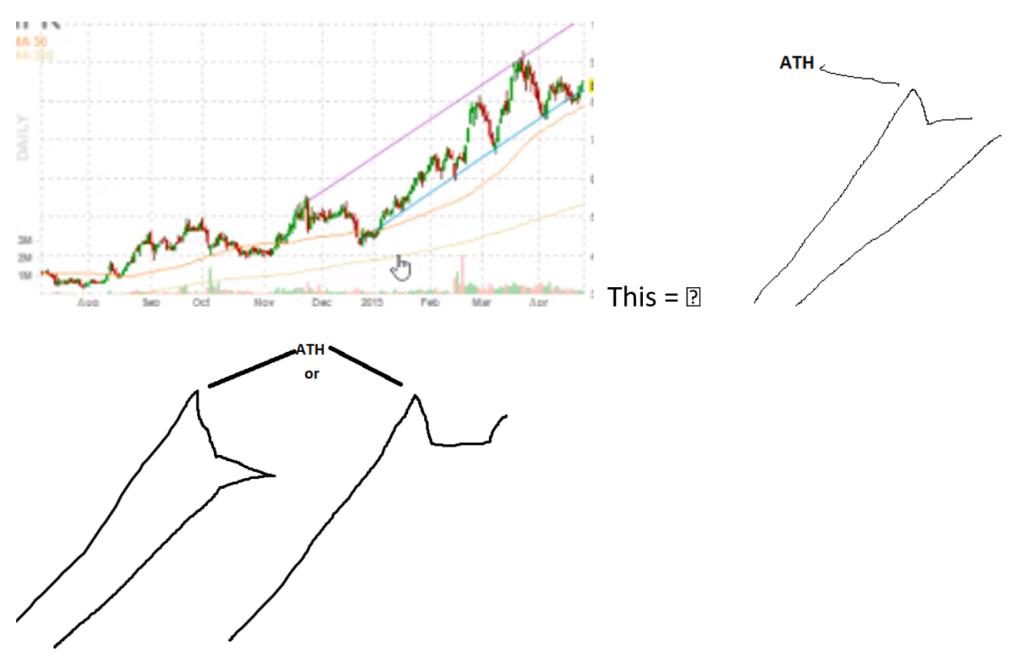

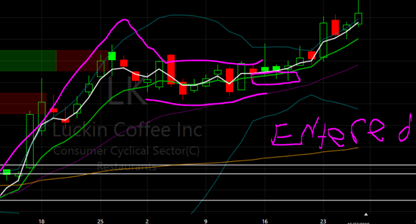

- The look of the chart needs to be something like this:

Green line above is the 8 EMA