Artificial intelligence (AI) is changing everything. It represents nothing short of the next Industrial Revolution.

It’s found its way into just about every industry and has the potential to add $13 trillion to the global economy by the end of the decade… And the technology is still in its infancy.

As you can imagine, the big boys of Wall Street have been throwing boatloads of cash into their AI development programs in an attempt to give themselves an edge over the competition in the market.

In 2024 alone, companies across America are projected to invest more than $68 billion into AI. Goldman Sachs has already hired 1,000 AI developers, a number it expects to expand to 12,000 by the end of 2024.

According to Tractica Research, by 2025, trading will be the No. 1 use case for AI that companies will invest in. It will allow them to invest faster and more accurately than any human trader could ever hope to.

It’s creating an AI wealth gap. As these trading houses and billionaires use AI to get even richer, your average American will fall behind. Everyday people like you and me don’t have millions of dollars to spare to develop trading AI.

But we don’t have to, we have S.A.M…

Finding EXPLOSIVE Trade Setups With S.A.M.

The Stock Acceleration Monitor – S.A.M. for short – is a brand-new AI-powered trading tool that can automatically scan the market, pinpoint what stocks to trade and even predict when to get into a trade to maximize gains.

With it, our Daily Profits Scanner can find stock surges accurately. Most people overlook the things that S.A.M. is programmed to find… And they’re impossible to track using Yahoo Finance or any “mainstream” website. But because of its advanced AI, S.A.M. spots them immediately.

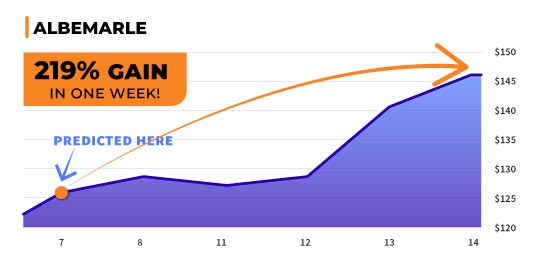

You can see this happening in real time in Albemarle…

When S.A.M. predicted this event, it indicated for us to buy on the red circle… And doing so could’ve resulted in a 219% gain in just one week.

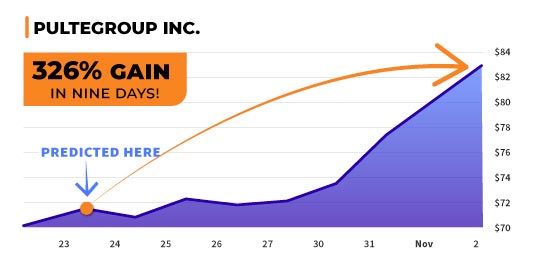

Same with the stock PulteGroup Inc… It predicted this trigger on the red circle and could have resulted in a 326% gain in just nine days…

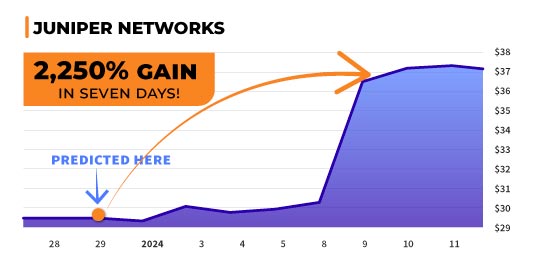

Same with Juniper Networks, which spotted the trigger on the white circle on this chart. But this time, it could’ve resulted in a 2,250% gain… enough to turn every $1,000 into $23,500 in just seven days.

Our new AI-powered research tool…

- Finds the perfect trade setups in real time

- Does it with blazing-fast speed

- Helps you perfectly time when to get in.

So how does S.A.M. work, and what trigger does it look for?

Squeezing All the Profits From the Market

Put simply, S.A.M. does what I do, only faster. The AI is programmed to use the key strategy behind my best trades, TPS – or trend, pattern, squeeze.

Those are the three things I look for in every single trade, and they’re extremely powerful. In fact, within the first 10 months of opening Daily Profits Live last year, I closed 43 winning trades with at least 100% gains.

Let’s talk first about the primary indicator of my TPS strategy, the squeeze.

The squeeze was developed by a legendary trader called John Carter. And from its inception two decades ago, it has become an “everyman’s indicator.”

Now, in finance, “squeeze” can describe a couple of different situations. I’ll get to that in a minute, but in basic terms it’s pretty simple. The squeeze system basically measures the “pressure” in a stock.

That pressure builds up, and when it releases it creates big momentum that drives stocks up fast.

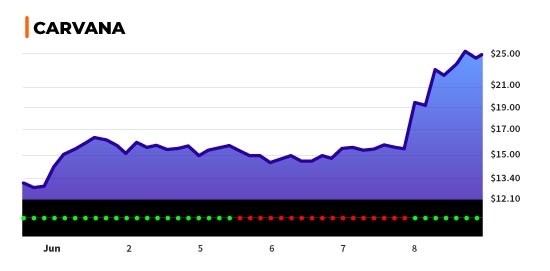

Take a look at the chart below. It’s from an actual real-time, real-money trade that I recently made. At the bottom, you’ll see a series of dots that go from green to red.

That is the squeeze indicator in action on the stock Carvana… It essentially measures the built-up buying pressure in a stock.

A good illustration of this is the firing of a gun. Inside the cartridge of a gun, there’s a primer, propellant and a bullet, all enclosed in a casing.

When you pull the trigger, you ignite the primer, which causes the propellant, i.e., the gunpowder, to explode and create massive pressure in the chamber behind the bullet. That pressure has nowhere to go but forward, so it takes the path of least resistance and pushes the bullet out of the barrel.

Stock squeezes work the same way. As the stock’s price moves down, it builds price compression, just like how the exploding powder creates pressure behind the bullet in a gun.

Buyers start putting in orders because the stock is available at a better price. The more buyers who move in, the more pressure builds for the stock to move upward.

When the pressure behind the stock gets to be too great, it has nowhere to go but up, driving the stock’s price up as quickly and as powerfully as a bullet leaving the barrel of a gun.

What my TPS strategy aims to do then is to enter a trade when a stock’s compression is at its maximum, just before it bursts higher. Let’s take another look at that Carvana chart. See where the dots change from green to red? That’s our signal to buy.

Now, without S.A.M., I had to enter the trade manually, so I had to wait a day after the squeeze hit to get in. I was late but still in time for the stock to explode upward and net me a 250% gain in just two days.

Essentially, the squeeze tells you when to enter a trade once the stock’s price has enough compression to erupt… and when to get out when it loses compression.

The profit potential was enormous when I was still doing this manually. But now we have S.A.M., and it does all of the tracking I used to do manually on my six trading screens faster and more accurately than any human ever could.

Using my manual system, I can set up a few hundred trades per year, and some of them are going to result in losses. S.A.M., on the other hand, looked at 2023’s market data and located 1,345 potential trades. Of those, 1,068 were winners. The average trade lasted just 10 days and had a win rate of 79.41%.

On average, when backtested, S.A.M. located 1,214 profitable trade setups per year, or about five winners per day.

S.A.M. is capable of seeing all the active squeezes across all S&P 500 stocks and the direction of each stock’s momentum. This gives investors an opportunity to analyze a chart before buying into a trade. S.A.M. can do it all on one single screen, pinpoint short-term and long-term opportunities, and let you know if you’re looking at a bullish or bearish setup… fast too.

S.A.M. can scan the stock market 5 million times per second. It would take a human years or even decades to look through all of that data just once.

So now, at long last, let’s pop open the hood and see what makes S.A.M. tick…

The AI Analyst

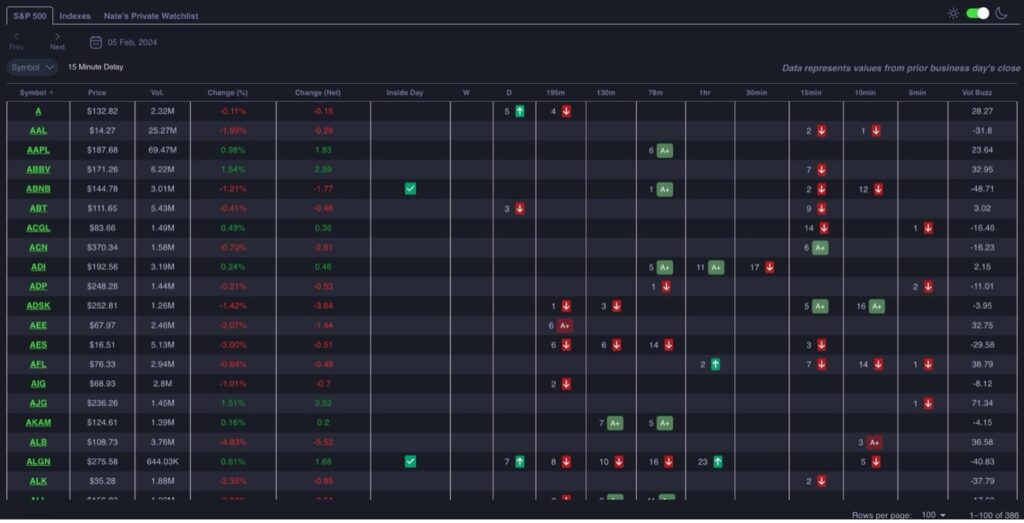

S.A.M. is a young AI that will become even better over time, but it is already our secret weapon in the stock market. Take a look!

I know this might look a little scary at first blush, but don’t worry. I’ll explain everything, and S.A.M. is easy to use once you know how to read its output.

But one thing that is important to understand is that unlike with most stock scanners people use, you don’t have to enter any criteria with. S.A.M. It does that for you thanks to the power of AI…

Once you open the software, you will immediately see all of the active squeezes happening with S&P 500 stocks as well as the six top index ETFs across different time frames…

With S.A.M., you can look for both fast profit opportunities and longer-term profit opportunities…

Each column represents a different time frame. When a stock is in a squeeze, it’s reflected with a single number, what I call a squeeze score…

It represents how long a squeeze has been active. Now, we want to get into a setup as fast as we can… preferably if the squeeze number is 10 or under. Because by the time this number hits 15 or 20… we’re likely too late.

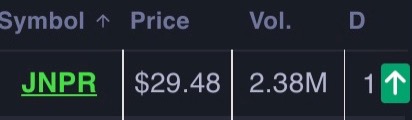

So we want the number to be low. Let’s look at Juniper Networksat the end of 2023…

We can see that the squeeze score in the daily column was 1, meaning the squeeze had just begun.

A squeeze score of “1” is great – it means that we have a new squeeze. And right next to this number is a green arrow…

It reflects that the stock has positive momentum. In other words, it’s heading up. When the arrow turns green, it’s time to buy.

If a stock has a squeeze score of 1 inside the daily column, that tells me the pressure is now releasing and the stock is beginning its upward move.

This is the time to buy.

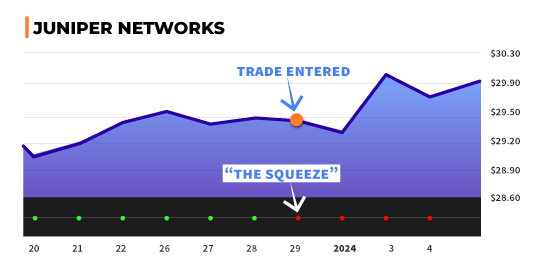

Now let’s take a look at a chart of Juniper’s stock. You can see the squeeze happening in real time.

S.A.M. detected it right where the dots turned from green to red…

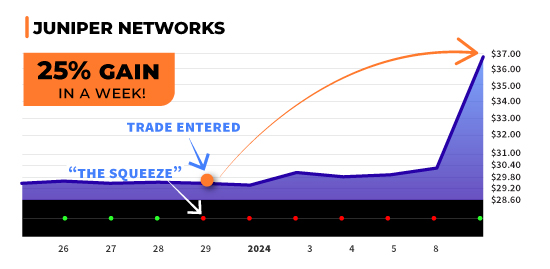

And sure enough, over the next week, the stock exploded 25% higher.

Imagine kicking a new year off by beating the S&P 500’s 2023 returns during the very first week of the year…

In fact, historically, over the past 174 years, the S&P 500 has exceeded a 20% annual return about once every five years.

But with just one squeeze setup on ONE ticker, S.A.M. helped us capture an entire year’s worth of gains. And we can supercharge our gains using the power of options.

See, if we can predict a short time frame for a stock going up in value sharply, an options play is the perfect way to capitalize on it. So what are options and how do they work?

Supercharging Your Profits

Options are contracts that allow their holder to buy (calls) or sell (puts) 100 shares of a given stock by a specified date (the expiration date) and a specified price (the strike price).

Options come in two varieties, calls and puts. I will explain puts for your edification, but ultimately we will be using S.A.M. primarily for call options…

Call options are contracts that give their holder the right – but not the obligation – to buy shares at a certain price.

They’re essentially a bet that the price of the underlying stock will rise above the option’s strike price by expiration… and the contracts will give their owner the ability to buy at a discount.

When that happens, those calls are referred to as “in the money.” If the stock’s price is below the call option’s strike price, it’s referred to as “out of the money.”

Put options are the opposite of calls.

A put option is a contract that gives its holder the right – but again, not the obligation – to sell shares at a predetermined strike price.

It’s a bet that the price of the underlying stock will sink below the option’s strike price and the contracts will give their owner the ability to sell at a premium.

Options allow you to magnify stock moves. A big move for a stock might see its share price move 5% on a given day. An option for that stock might jump 50% or more, depending on the strike price.

Now, how do options actually work?

In short, they’re pretty simple, but we have to discuss one detail about options that confuses many new investors. Say we’re looking at a Company X (NYSE: XYZ) call option that expires in January 2025. It has a strike price of $60 and is currently listed at $3.50.

Each option contract represents 100 shares of its underlying stock. That means $3.50 is the per-share premium. The actual price is $3.50 multiplied by 100, so one contract costs $350.

To buy 100 shares of Company X stock without options, you would have to lay out nearly $6,000 at current prices. The option costing only $350 is a pretty great bargain by comparison.

For example, if the value of an option’s underlying shares moves just 5% to 10%, the options associated with it could move 50% to 100%… and sometimes even more.

Here’s how things might work with our Company X play. Say we buy in for $3.50 now, and at the January 17, 2025, expiration date, Company X is sitting at $70. That’s $10 above our strike price, so we could exercise our option here and buy 100 shares at a $10 discount per share. We could also sell our options at expiration for $10, or $1,000 ($70 share price minus $60 strike price), which would be a 186% return on your $350 investment.

Now, say we had bought 100 shares of Company X outright at $60 and sold at $70. That’s a gain of 17%, or $1,000. Our dollar-value return was higher with the option, and we put considerably less money at risk – less than 6% of the cost for 100 shares at market.

Now, buying options is really no different from buying stocks, at least in terms of how you do it. Most online brokers will let you trade them as long as you are approved to trade options.

Approval is very simple to get. You usually just have to fill out a form. Contact your broker for details, or download the options approval form from its website.

If you’re new to options trading, be sure to read all the material your broker sends you before you start trading. You should talk to your broker and have all your questions answered until you feel comfortable.

It might take some time to familiarize yourself with all the intricacies of options trading, but setting up an account to trade can be done in as little as five minutes.

Now, buying stock is simple. You just log in to your brokerage account, search by the company’s symbol or name, select the number of shares you want, and click “buy.”

Buying options is just as easy, but it has a couple of extra steps. Start by looking up the options available for the stock you want.

When you’ve found your option, identified by its expiration date and strike price, click “buy to open” or “sell to close.” It’s that simple.

Now, with an asset-like options that magnify movements in the stock market, you can easily see how S.A.M. predicting those moves would make options even more powerful and vice versa.

And look…

I know a lot of people are scared of options and view them as super risky. But like anything in life… they are risky if you use them the wrong way.

Lots of people think stocks are less risky than options… but starting out I lost all of my money on stocks three separate times.

Stocks and options both have risk, and nothing in trading is guaranteed. You should never trade with money you can’t afford to lose. But options give you a huge advantage over stocks…

They allow you to put less money at risk while also targeting higher gains. And it’s how you’re able to make triple- or even quadruple-digit gains in mere days.

With stocks, that’s almost impossible.

But if you use them correctly, like by using them with the power of S.A.M., you can win with potentially massive gains.

All it takes is a small move upward in a stock’s price to be a big winner for options traders. And S.A.M. will hand us hundreds of opportunities each year to profit from stock moves both big and small…

In fact, we built a feature into S.A.M. that even suggests three different options contracts for daily setups based on the option selection criteria that I use every day.

I call them “power options.”

You can choose from three different power options based on your risk tolerance level, conservative, moderate or aggressive, so you can control how you put S.A.M. to work for you.

Rinse and Repeat…

S.A.M. is our secret weapon to not fall behind in the AI arms race being waged on Wall Street. This system will make sure that we don’t fall into the AI wealth gap.

By identifying hundreds of squeeze opportunities faster than I could ever hope to, S.A.M. will allow us to supercharge our trading.

AI is changing everything, but change isn’t always a bad thing, and it’s almost always an opportunity. This is your opportunity to bring the power of Wall Street’s trading AI to Main Street and capture that profit for yourself.

Welcome to Daily Profits Scanner!